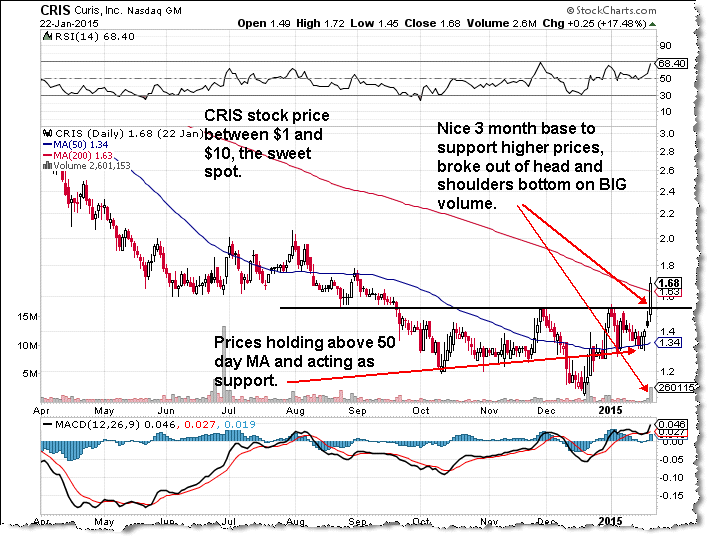

What makes a stock a good buy? In my opinion a combination of technical (chart patterns) and fundamentals will yield the best results. I have found that small cap stocks with a price between $1 and $10 are the sweet spot. I want to stay away from stocks under a dollar and over $10 I don’t have enough leverage.

The best swing trade candidates are stocks that have been basing for a while, several months or more. What you want to see is a breakout of the base on HUGE volume. This is usually as a result of an unexpected earnings surprise or some new product or service.

Once I spot a stock breaking out of a base, I like to purchase a half position. Then I wait for the inevitable pullback that forms a bull flag or wedge. However, in case it doesn’t I at least have my half position.

As soon as the stock breaks out of the flag you want enter the second half of your position for a swing trade. If you are a more conservative trader you would be entering here. Ideally we want to ride the stock for several weeks or months for massive gains of 100% or more.

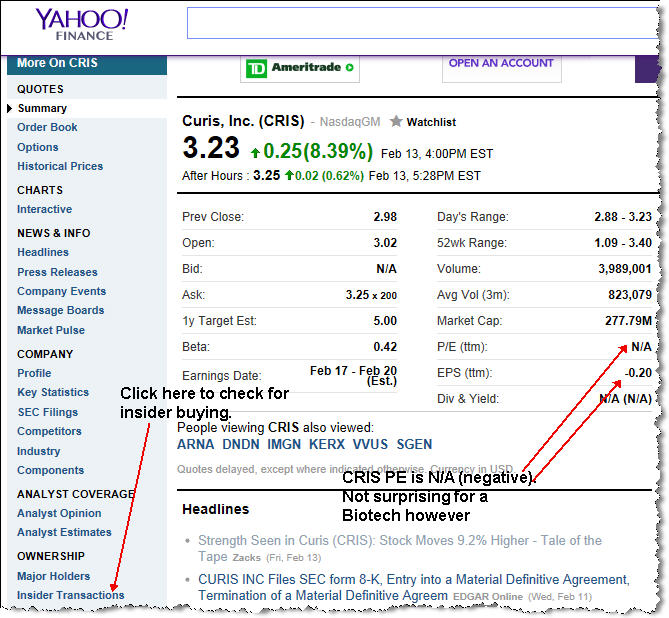

Less important, but still a factor are the fundamentals of the company. Stocks that trade for under $10 are usually not profitable, meaning PE is <0 or negative. A stock under $10 that is profitable and has the right technical pattern and you may have yourself a real winner.

Check out: http://finance.yahoo.com

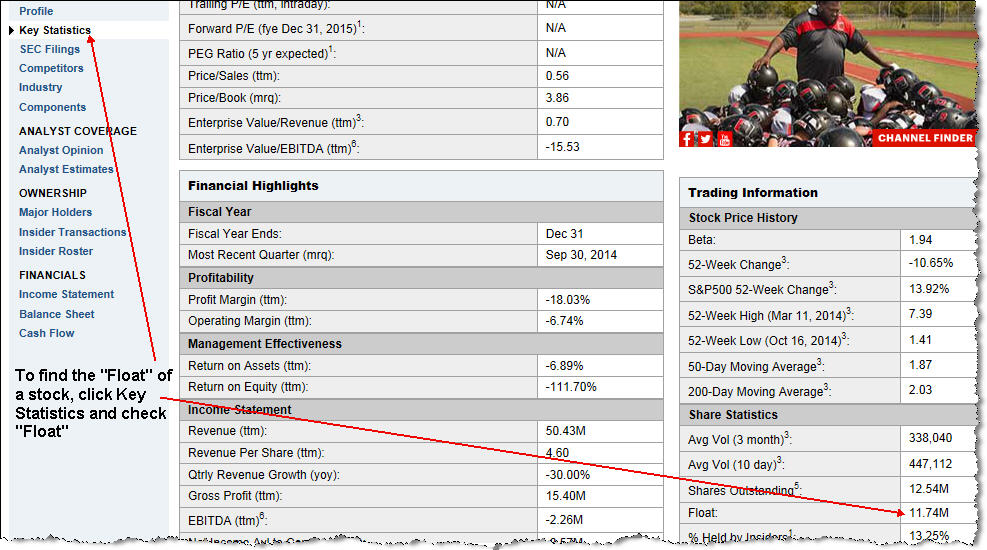

I really like to see a stock that has a low float, meaning that there are less than 20 million shares available to trade. Having a low float makes it much easier to rise as it takes less buying power to make it go higher.

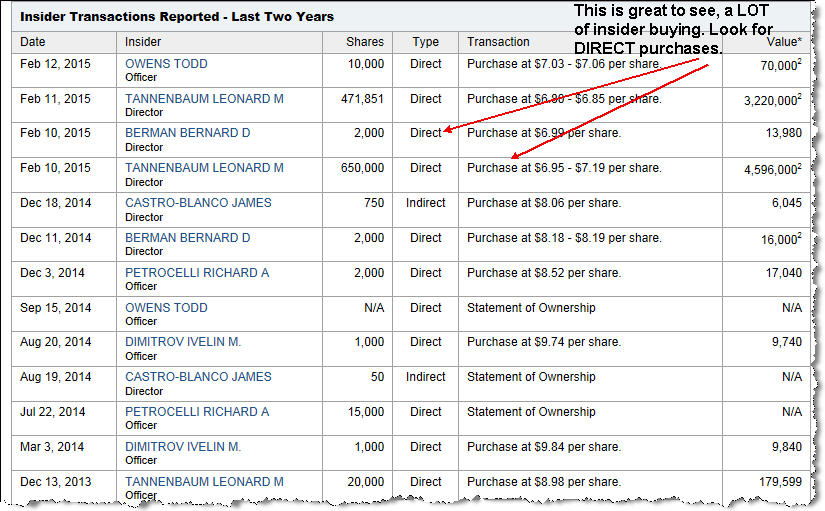

Another great thing to see is insider buying. While there are many reasons for a company insider to sell their stock, there is only one reason they buy their own stock, it’s that they expect it to rise in price!

(Click on Insider Transactions on the left under Ownership)

The last factor is somewhat arbitrary and that is a “story” or “theme”. We want the company to be selling products or services that can lead to explosive earnings. These companies are usually in the technology or biotech sectors so I concentrate mostly on those two sectors.

Here is a check list for finding a “SuperStock” for a swing trade, the more you can check off the better the odds of a real winner.Technical

- Breakout of a long base on BIG volume

- Stock corrects on low volume forming a bull flag or wedge

- Stock price between $1 and $10

- Above 50 Day MA

Fundamental

- Company is profitable ie: PE>0 (most likely not going to happen for a biotech)

- Low Float, shares available for trading is less than 20 million (Less than 10 million is a big plus)

- Good story or catalyst to enable higher prices

- Insider buying

Of all of these factors, by far the MOST important is a basing period of several months or more followed by a breakout on BIG volume.

Part 2 of this article will focus on finding these setups.

Make it easy on yourself and follow a professional swing trader who knows how to locate these “SuperStocks” and can help guide you to becoming a profitable trader.

Here are the two stock picking services I use for almost all of my trades: Microcap Millionaires and Jason Bond Picks

You can read my reviews here: Microcap Millionaires Review and Jason Bond Picks Review

If Penny Stocks are your thing, then you should definitely check out Microcap Millionaires.

Read my review of Microcap Millionaires

You can read all my reviews on stock picking services here:

If you are looking to open a brokerage account or looking for a better one, I wrote some reviews of brokers I have used and currently using.

OptionsHouse Review (Currently Using)

Scottrade Review (Used when I first started)

If you have any questions feel free to contact me.

– Robert Walsh